As a senior, planning for your future is crucial, especially when it comes to matters of the heart. Enter the “Prenuptial Agreement For Seniors” – a tailored solution designed to provide you with peace of mind. This innovative product offers you the opportunity to protect your assets and ensure financial security as you enter into a marriage or long-term partnership later in life. In this article, you will discover valuable insights and key considerations surrounding prenuptial agreements for seniors, empowering you to make informed decisions and take the necessary steps to safeguard your financial well-being. So, whether you’re embarking on a new chapter or seeking to protect your existing assets, the “Prenuptial Agreement For Seniors” is your ally in securing a brighter future.

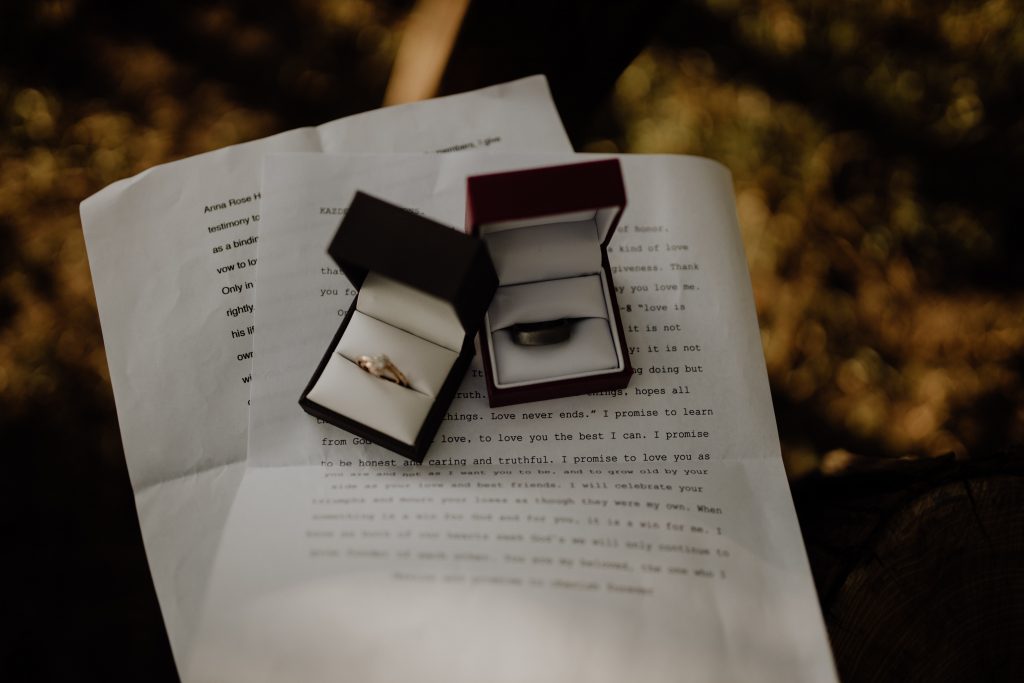

This image is property of images.unsplash.com.

Why Seniors Should Consider a Prenuptial Agreement

Protecting Retirement Assets

As seniors near retirement or are already enjoying their golden years, protecting their retirement assets becomes paramount. A prenuptial agreement allows individuals to designate specific assets as separate property, ensuring their financial security in the event of divorce or death. By clearly outlining what assets are considered marital and separate property, seniors can safeguard their hard-earned savings and investments.

Preserving Inheritance for Children and Grandchildren

For seniors with children and grandchildren, preserving their inheritance is often a top priority. A prenuptial agreement can provide peace of mind by outlining how assets will be distributed to heirs in the event of divorce or death. By clearly identifying separate property and addressing inheritance, seniors can ensure that their loved ones receive their intended legacies.

Addressing Debt and Financial Obligations

Seniors may have accumulated debt over the years, such as mortgages or loans, that they must address when entering into a new marriage. A prenuptial agreement allows individuals to outline each partner’s responsibility for debt and other financial obligations. By clarifying these matters upfront, seniors can avoid potential disputes and protect their financial well-being.

Ensuring Medical Decision-Making Rights

Medical decision-making is a critical concern for seniors. By including provisions in a prenuptial agreement, individuals can ensure that their chosen healthcare agent retains the authority to make medical decisions on their behalf. This is particularly important should a spouse become incapacitated or unable to make decisions independently.

Accounting for Healthcare Costs

Seniors often face significant healthcare expenses as they age. Including provisions in a prenuptial agreement to address these costs can help individuals plan for their future medical needs. By considering the potential costs of long-term care, nursing homes, and other medical treatments, seniors can mitigate financial burdens and protect their assets.

Avoiding Probate

Probate can be a complex and time-consuming process, which is why many seniors seek to avoid it. A prenuptial agreement can help individuals designate how their assets will pass to their heirs, bypassing probate. By clarifying how assets should be transferred and distributed, seniors can streamline the inheritance process and minimize potential delays or disputes.

Clarifying Expectations and Responsibilities

Clear communication and shared expectations are vital for any successful marriage, especially for seniors who may have different financial circumstances. A prenuptial agreement allows couples to openly discuss their expectations regarding finances, living arrangements, and other responsibilities. By addressing potential areas of conflict in advance, seniors can foster a strong and harmonious partnership.

Mitigating Potential Legal Battles

Divorce or the death of a spouse can lead to contentious legal battles, which can be emotionally and financially exhausting for seniors. A prenuptial agreement can help mitigate these potential conflicts by clearly outlining the division of assets and property. By establishing a fair and equitable agreement, seniors can minimize the likelihood of costly legal disputes and preserve their well-being.

Considering Unique Financial Circumstances

Seniors often have unique financial circumstances, such as retirement funds, pension benefits, and stock portfolios. A prenuptial agreement provides an opportunity to address these specific financial complexities and ensure that both parties fully understand and acknowledge each other’s financial situation. By accounting for these unique circumstances, seniors can protect their financial interests and establish a solid foundation for their marriage.

Understanding the Legal Requirements

When considering a prenuptial agreement, seniors should familiarize themselves with the legal requirements of their state. Each state may have specific laws governing prenuptial agreements, such as the need for full financial disclosure and the enforceability of certain clauses. It is essential to consult with a knowledgeable elder law attorney to ensure compliance with state laws and to draft a comprehensive and legally sound agreement.

Consulting with an Elder Law Attorney

Finding an Experienced Elder Law Attorney

To navigate the complexities of a prenuptial agreement, seniors should seek the expertise of an experienced elder law attorney. These specialized attorneys have in-depth knowledge of laws and regulations specific to seniors and can provide tailored advice to meet their unique needs.

Scheduling an Initial Consultation

Once a suitable attorney is identified, seniors should schedule an initial consultation to discuss their personal and financial circumstances. This initial meeting allows the attorney to understand the individual’s goals, concerns, and specific needs related to the prenuptial agreement.

Discussing Personal and Financial Circumstances

During the consultation, seniors should be prepared to discuss their personal and financial circumstances openly. This includes disclosing their assets, debts, and any other relevant financial information. Such transparency ensures that the attorney can accurately assess the situation and provide appropriate guidance.

Exploring Specific Concerns and Goals

Seniors should take the time to communicate their specific concerns and goals regarding the prenuptial agreement. This may involve discussing desired asset protection, inheritance plans, healthcare decision-making, or any other pertinent matters. The attorney will then customize the agreement to reflect these preferences and address individual needs.

Understanding the Process and Timeline

The attorney will explain the entire process and timeline for creating a prenuptial agreement. This includes gathering necessary documentation, drafting the agreement, and seeking input from both parties. Understanding the process and timeline allows seniors to anticipate the steps involved and plan accordingly.

Reviewing Drafts and Negotiating Terms

Once the initial draft of the prenuptial agreement is prepared, seniors should carefully review it with their attorney. This review process offers an opportunity to negotiate and refine the terms of the agreement to ensure they accurately reflect the individual’s wishes.

Finalizing the Prenuptial Agreement

Once all terms have been negotiated and agreed upon, the final version of the prenuptial agreement can be prepared. Seniors should review the final document carefully with their attorney before signing to ensure its accuracy and completeness.

Ensuring Compliance with State Laws

It is essential to ensure that the prenuptial agreement complies with the laws of the state in which it will be enforced. Elder law attorneys will be well-versed in the specific legal requirements of different states and can ensure that the agreement meets these standards.

Updating the Agreement as Needed

Seniors should be prepared to revisit and update the prenuptial agreement as needed. Life circumstances may change, and it is crucial to address these changes in the agreement to maintain its relevance and effectiveness.

Revisiting the Agreement in the Event of a Divorce or Death

In the event of a divorce or the death of a spouse, seniors should consult with their attorney to review and understand the implications of the prenuptial agreement. The attorney can provide guidance on the steps to follow and the provisions outlined in the agreement.

Prenuptial Agreement For Seniors

Key Factors to Consider in a Prenuptial Agreement

Full Financial Disclosure

One of the key factors in a prenuptial agreement is full financial disclosure. Both parties must provide complete and accurate information about their assets, debts, income, and financial obligations. Full disclosure ensures transparency and fairness in the agreement.

Identification of Separate and Marital Property

Clearly distinguishing separate property from marital property is critical in a prenuptial agreement. This distinction helps protect each partner’s individual assets and ensures that they retain ownership, control, and inheritance rights over those assets.

Determining Spousal Support

In a prenuptial agreement, couples can address the issue of spousal support, also known as alimony or spousal maintenance. By including provisions for spousal support, couples can establish the terms and conditions under which financial support will be provided in case of divorce or separation.

Providing for Special Needs or Caregiving Costs

If one or both partners have special needs or anticipate caregiving expenses in the future, a prenuptial agreement can address these concerns. The agreement can include provisions for allocating resources and financial support for the partner requiring special care or assistance.

Accounting for Taxes and Retirement Benefits

Tax implications and retirement benefits are important considerations in a prenuptial agreement. By accounting for these factors, seniors can protect their retirement savings, plan for future taxes, and ensure a fair and secure financial future.

Defining Asset Distribution in Case of Death

The prenuptial agreement should clearly outline how assets will be distributed in the event of death. It can specify which assets will be transferred to the surviving spouse, children, or other designated beneficiaries. This provision helps avoid legal disputes and ensures the deceased individual’s wishes are honored.

Addressing Changes in Circumstances

Life is dynamic, and circumstances can change over time. A prenuptial agreement should include provisions for addressing changes in financial circumstances, such as inheritances, windfalls, or unforeseen expenses. By accounting for these potential changes, the agreement remains relevant and adaptable.

Considering Mediation or Arbitration Clauses

Including mediation or arbitration clauses in the prenuptial agreement can help resolve disputes in a more amicable and private manner. These clauses provide an alternative to costly and adversarial court battles, allowing couples to work through disagreements with the assistance of neutral professionals.

Including Sunset Clauses

Sunset clauses establish a predetermined timeline for the prenuptial agreement to expire or be revisited. This provision provides an opportunity for couples to reevaluate their financial arrangements after a certain period of time, ensuring that the agreement remains fair and relevant.

Reviewing and Updating the Agreement Regularly

To ensure the prenuptial agreement remains accurate and effective, it is essential to review and update it regularly. Couples should schedule periodic meetings with their attorney to assess any changes in their financial circumstances or goals and make necessary adjustments to the agreement.

Potential Challenges and Limitations

Laws Vary by State

Prenuptial agreement laws vary by state, which means it is essential for seniors to understand the specific regulations and requirements in their jurisdiction. Consulting with an experienced elder law attorney familiar with the applicable laws is crucial to ensure the agreement’s enforceability.

Enforceability Challenges

Prenuptial agreements can face challenges in court if they are found to be unconscionable, unfair, or fraudulent. It is necessary to work with an attorney to draft an agreement that adheres to legal standards to maximize its enforceability.

Negotiation and Communication Issues

Negotiating the terms of a prenuptial agreement can be challenging, particularly when there are differing financial circumstances, expectations, or emotional sensitivities. Effective communication and compromise are essential to ensure both parties feel heard and represented in the agreement.

Emotional and Relational Dynamics

Discussing a prenuptial agreement can be emotionally charged, especially for seniors who may have experienced divorce or loss in the past. It is crucial to approach these conversations with empathy and understanding, prioritizing the preservation of the relationship and long-term happiness.

Uncertain Future Circumstances

While a prenuptial agreement can provide a roadmap for the future, it cannot predict or account for every possible scenario. Unforeseen circumstances, such as shifts in the economy or changes in tax laws, may impact the agreement’s effectiveness. Revisiting and updating the agreement periodically can help address these unknowns.

Effectiveness in Complex Family Structures

Seniors with complex family structures, such as blended families or adult children from previous marriages, may face additional challenges in drafting a prenuptial agreement. It is crucial to work closely with an experienced elder law attorney to ensure all familial dynamics are considered and properly addressed.

Exploring Alternatives to a Prenuptial Agreement

Some seniors may find that a prenuptial agreement does not align with their personal values or relationship dynamics. In such cases, exploring alternative methods of asset protection, such as trusts or postnuptial agreements, may be more suitable.

Preventing Unintentional Co-mingling of Assets

It is important for seniors to avoid unintentional co-mingling of assets, as this can weaken the enforceability of a prenuptial agreement. Clear communication and careful management of finances can help ensure that a separation between marital and separate property is maintained.

Balancing Individual and Collective Interests

Crafting a prenuptial agreement requires a delicate balance between individual interests and the preservation of the relationship. Seniors should prioritize open communication, empathy, and compromise to achieve an agreement that protects their assets while maintaining a strong partnership.

Considering Future Tax and Estate Planning Requirements

Prenuptial agreements should align with the future tax and estate planning requirements of the individuals involved. Collaborating with a knowledgeable elder law attorney and financial advisor can help ensure that the agreement integrates with broader financial and estate planning strategies.

This image is property of images.unsplash.com.

Addressing Common Concerns of Seniors

Fear of Offending or Hurting the Partner

Bringing up the topic of a prenuptial agreement can be daunting, as seniors may fear it will offend or hurt their partner. It is essential to approach the conversation with empathy, explaining the purpose behind the agreement and emphasizing its role in protecting both parties’ best interests.

Preserving Harmony within the Family

Seniors often strive to preserve harmony within their families and may worry that a prenuptial agreement could strain relationships. By openly discussing the reasons for implementing an agreement and reassuring their loved ones about their intentions, seniors can foster understanding and maintain family bonds.

Protecting Existing Assets and Inheritance

One of the primary reasons seniors consider a prenuptial agreement is to protect their existing assets and inheritance. Communicating this intention to their partner can help alleviate concerns and ensure that both individuals understand and respect each other’s financial priorities.

Minimizing Future Financial Conflicts

Addressing potential financial conflicts through a prenuptial agreement can actually minimize them in the future. By establishing clear guidelines and expectations around financial matters, seniors can reduce the likelihood of disputes and maintain a healthier financial partnership.

Maintaining Autonomy and Control

Seniors often seek to maintain a sense of autonomy and control over their financial affairs. A prenuptial agreement allows them to retain this control by clearly outlining their wishes and expectations, providing peace of mind for the future.

Ensuring Long-Term Financial Security

Planning for long-term financial security is crucial for seniors. By including provisions in a prenuptial agreement that protect their retirement assets and address potential healthcare costs, seniors can safeguard their financial well-being and achieve peace of mind.

Securing Healthcare Decision-Making Rights

Ensuring healthcare decision-making rights is a significant concern for seniors. By clarifying these rights through a prenuptial agreement, individuals can have confidence that their chosen healthcare agent will have the authority to make decisions on their behalf in the event of incapacity.

Avoiding Expensive Legal Battles

One of the primary benefits of a prenuptial agreement is the avoidance of costly legal battles in the future. By proactively addressing potential disputes and defining asset distribution, seniors can reduce the financial and emotional burden associated with lengthy court battles.

Providing for Adult Children with Special Needs

Seniors with adult children who have special needs require careful consideration and planning. A prenuptial agreement can include provisions that ensure the ongoing financial support and care of adult children, providing peace of mind for both the seniors and their children.

Protecting Retirement and Pension Benefits

Preserving retirement and pension benefits is often a top concern for seniors. A prenuptial agreement can designate these assets as separate property, safeguarding them from potential division in the event of divorce or death.

Special Considerations for Older Adults

Capacity and Competency Evaluation

Evaluating capacity and competency is essential for seniors when entering into a prenuptial agreement. Seeking the guidance of medical and legal professionals to assess the individual’s ability to make informed decisions is crucial to ensure the validity and enforceability of the agreement.

Guardianship and Power of Attorney

Older adults should review and update their guardianship and power of attorney documents alongside a prenuptial agreement. Ensuring that these legal instruments align with the wishes outlined in the prenuptial agreement is vital to maintain consistency and protect the individual’s best interests.

Considering Future Healthcare Needs

As individuals age, healthcare needs often evolve. Seniors should contemplate their potential future healthcare needs and address them in the prenuptial agreement. By including provisions for these needs, individuals can plan for the associated costs and ensure the availability of necessary resources.

Estate Planning and Will Updates

A prenuptial agreement should complement existing estate planning documents, such as wills and trusts. Seniors should work with their attorney to review and update these documents to ensure they align with the provisions outlined in the prenuptial agreement.

Identifying Changes in Financial Circumstances

Seniors should periodically evaluate their financial circumstances to account for changes that may impact the effectiveness of the prenuptial agreement. This includes identifying changes in income, assets, debts, or other financial factors that may require amendments to the agreement.

Discussing Long-Term Care and Nursing Home Costs

Planning for long-term care and nursing home costs is critical for seniors. A prenuptial agreement can outline each partner’s responsibility for these expenses, ensuring that both individuals are well-prepared for potential future care needs.

Involving Trusted Advisors and Family Members

Seniors should involve trusted advisors, such as attorneys and financial planners, in the prenuptial agreement process. Additionally, engaging family members in open and honest discussions about the agreement can foster understanding and support.

Exploring Health Insurance and Medicare Coverage

Health insurance and Medicare coverage should be considered when drafting a prenuptial agreement. Seniors should understand how their healthcare coverage may be impacted by the agreement and work with their attorney to address any potential gaps.

Understanding Social Security Implications

Seniors receiving Social Security benefits should be aware of the implications of a prenuptial agreement on these benefits. Consulting with an attorney and a Social Security expert can help navigate this complex area and ensure the agreement aligns with Social Security regulations.

Considering Potential Medicaid Eligibility

For seniors with potential Medicaid eligibility concerns, a prenuptial agreement can help protect assets while still maintaining eligibility for government assistance. Legal guidance is crucial to ensure compliance with Medicaid regulations and preserve the individual’s financial security.

This image is property of images.unsplash.com.

Determining if a Prenuptial Agreement is Right for You

Understanding Personal and Financial Goals

Before considering a prenuptial agreement, seniors should reflect on their personal and financial goals. Understanding one’s priorities and long-term objectives can help individuals determine whether a prenuptial agreement aligns with their overall plans.

Exploring Open and Honest Communication

Seniors should engage in open and honest communication with their partner about the need for a prenuptial agreement. Through these conversations, both individuals can ensure they have a shared understanding and work toward a mutually beneficial agreement.

Considering the Financial Impact of Divorce

While seniors may enter a new marriage with optimism, it is crucial to consider the potential financial impact of divorce. Assessing the potential costs and consequences can help individuals make informed decisions about whether a prenuptial agreement is necessary.

Assessing the Potential Benefits and Drawbacks

Seniors should carefully weigh the potential benefits and drawbacks of a prenuptial agreement. Considering factors such as asset protection, inheritance planning, and the avoidance of legal disputes can help individuals determine the value and importance of having such an agreement in place.

Weighing Emotional and Practical Factors

Prenuptial agreements involve both emotional and practical considerations. Seniors should evaluate how these factors intersect and determine whether the emotional discomfort associated with discussing and implementing an agreement is outweighed by the practical benefits it offers.

Confidence in Partnership and Future Plans

Seniors should assess their level of confidence in their partnership and future plans. Trust, mutual respect, and shared goals are important foundations for a successful marriage, and individuals should consider whether a prenuptial agreement aligns with their vision of a secure and happy relationship.

Considering the Advice of Legal and Financial Experts

Consulting legal and financial experts is essential when considering a prenuptial agreement. Professionals in these fields can provide guidance and unbiased advice based on their expertise, helping seniors make informed decisions about their financial future.

Prioritizing Individual and Family Interests

Seniors should prioritize their individual interests as well as the interests of their family members. It is crucial to strike the right balance between protecting one’s own assets and ensuring the well-being and inheritance of loved ones.

Assessing the Level of Financial Independence

Seniors should assess their level of financial independence and consider how it may impact the necessity of a prenuptial agreement. Those who rely heavily on their own assets or have significant financial obligations may find that a prenuptial agreement is more relevant and beneficial.

Considering the Potential Need for Long-Term Care

Seniors should also consider their potential long-term care needs. If there is a significant possibility of requiring expensive care, a prenuptial agreement can help protect assets and provide a financial safety net in the event of divorce or the death of a spouse.

Ethical and Emotional Considerations

Openness and Transparency with the Partner

When initiating discussions about a prenuptial agreement, it is vital for seniors to be open and transparent with their partner. By openly sharing their concerns, goals, and intentions, both individuals can work together to build trust and mutual understanding.

Respecting Autonomy and Individuality

Respecting each partner’s autonomy and individuality is essential throughout the prenuptial agreement process. It is crucial to address concerns and negotiate terms in a way that acknowledges and respects each individual’s unique wants, needs, and expectations.

Recognizing Potential Power Imbalances

Seniors should be mindful of potential power imbalances that may exist between partners. An experienced elder law attorney can provide valuable guidance to ensure the process remains fair and equitable, protecting the rights and interests of each party.

Balancing Self-Interest and Fairness

Finding the right balance between self-interest and fairness is a crucial ethical consideration when creating a prenuptial agreement. By prioritizing fairness and compromise, seniors can navigate the agreement process while preserving the dignity and well-being of both parties.

Seeking Professional Counseling as Needed

Engaging in professional counseling is beneficial for seniors who may be facing emotional challenges related to a prenuptial agreement. A licensed therapist can provide support, guidance, and tools to help individuals manage their emotions and maintain healthy relationships throughout the process.

Managing Expectations and Emotions

Discussing and creating a prenuptial agreement can evoke strong emotions. Seniors should be prepared to manage these emotions and set realistic expectations throughout the process. Regular communication and empathy can help navigate sensitive discussions effectively.

Recognizing the Emotional Impact of a Prenuptial Agreement

A prenuptial agreement can carry emotional weight, as it involves addressing potential future scenarios surrounding divorce, death, or financial disputes. Seniors should recognize and validate their own feelings and those of their partner, allowing for open dialogue and understanding.

Considering the Value of Secure and Honest Relationships

While a prenuptial agreement addresses financial concerns, it should not overshadow the value of a secure and honest relationship. Seniors should strive to maintain open lines of communication, trust, and mutual respect throughout the agreement process, prioritizing the well-being of their relationship.

Resolving Conflicts through Mediation or Collaboration

If conflicts arise during the creation of a prenuptial agreement, seniors should explore options for resolving disputes through mediation or collaboration. These alternative dispute resolution methods can help bridge differences and promote constructive communication.

Maintaining the Dignity and Well-Being of Both Partners

Throughout the entire prenuptial agreement process, it is essential to prioritize the dignity and well-being of both partners. By treating each other with respect and compassion, seniors can create a foundation of mutual trust and understanding that strengthens their relationship.

Frequently Asked Questions (FAQs)

What is the purpose of a prenuptial agreement?

A prenuptial agreement serves the purpose of outlining the division of assets, debts, and other financial matters in the event of divorce or the death of a spouse. It allows individuals to protect their financial security and preserve their intentions regarding inheritance and financial obligations.

Can a prenuptial agreement be modified or revoked?

Yes, a prenuptial agreement can be modified or revoked, but the process must adhere to legal requirements. Both parties must agree to any modifications, and all changes should be documented in writing and signed by both individuals.

Will a prenuptial agreement protect my retirement savings?

A well-drafted prenuptial agreement can protect retirement savings by designating them as separate property. By clearly distinguishing retirement savings as separate assets, seniors can safeguard their hard-earned funds in the event of divorce or death.

Can a prenuptial agreement address healthcare decision-making?

Yes, a prenuptial agreement can include provisions for healthcare decision-making. By clarifying the authority granted to a chosen healthcare agent, seniors can ensure their wishes are honored, even if they become incapacitated.

What should I disclose in a prenuptial agreement?

In a prenuptial agreement, both parties should disclose their assets, debts, income, and financial obligations. Full and honest financial disclosure is crucial to ensure transparency and fairness in the agreement.

Can a prenuptial agreement include provisions for adult children?

Yes, a prenuptial agreement can include provisions for the support and care of adult children, particularly those with special needs. Including such provisions offers seniors peace of mind, knowing that their children’s financial well-being is secured.

Who should I involve in the prenuptial agreement process?

Seniors should involve their chosen elder law attorney, financial advisors, and trusted family members or friends who can provide emotional support. These individuals can help navigate the complexities of the process and ensure that seniors make informed decisions.

How can I discuss a prenuptial agreement with my partner?

Initiating a conversation about a prenuptial agreement requires sensitivity and empathy. Choose an appropriate time and place to discuss the topic, emphasize the importance of open communication, and emphasize that the agreement serves to protect the interests of both individuals.

What are the potential costs involved?

The costs associated with a prenuptial agreement vary depending on various factors, such as the complexity of assets, the need for legal advice or mediation, and the extent of negotiation required. Seniors should consult with an attorney to understand the potential costs involved in their specific situation.

Can a prenuptial agreement address future changes in circumstances?

Yes, a prenuptial agreement can include provisions for future changes in circumstances, such as inheritances, windfalls, or unforeseen expenses. By considering these potential changes and addressing them in the agreement, seniors can maintain its relevance and effectiveness.

Conclusion

Prenuptial agreements play a crucial role in empowering seniors to protect their assets, preserve their financial legacies, and address potential conflicts. By considering the various factors and challenges associated with prenuptial agreements, seniors can make informed decisions about their future financial security. Engaging the services of an experienced elder law attorney ensures seniors navigate the process with professionalism and receive personalized guidance throughout. With careful consideration, open communication, and expert advice, seniors can forge a prosperous future while preserving the dignity and well-being of their relationships.